- Premium salaries to be offered by new investors in Johor-Singapore SEZ

- Petronas is in the process of developing an oil block in Indonesia

- US credit has been downgraded.

IN Malaysia

Proposal to raise the retirement age to 65

Law Minister Azalina Othman, in her personal capacity, viewed that the mandatory retirement age should be bumped from the current 60-year-old threshold to 65 years old, as she felt that the individuals at their golden age are still energetic and productive. In Malaysia, the mandatory retirement age for government employees is currently set at 60. This is also the minimum retirement age for private sector employees under the Minimum Retirement Age Act 2012.

Source: https://theedgemalaysia.com/node/755917

Okay, let’s look at the economic case of raising the retirement age. Actually, the Department of Statistics Malaysia (DOSM) has already looked into this matter, as they stated that by encouraging older workers to remain in the workforce, it will further increase the overall labour participation rate. As in 2020, the labour force participation rate for individuals aged 55-64 was 67.5%, compared to 81.5% for individuals aged 25-54. According to a report by the World Bank, a 1% increase in the labour force participation rate in Malaysia could result in a 0.5% increase in GDP per capita. Besides, individuals who continue to work past the age of 60 would have additional years to save for retirement, which could help them build a larger nest egg and reduce the burden on the Government to provide social welfare post-retirement. But, personally, please do not increase the retirement age as it will limit the opportunity for the younger generation to be promoted and will make it harder for fresh graduates to enter employment. This is because jobs are finite, and someone has to go to make room for others. Jadi kepada yang dah lama berbakti, mungkin dah sampai masa untuk bersara dengan tenang… sambil-sambil tu, sempat lah juga lepak surau.

New investors in Johor-Singapore SEZ to offer premium salaries

Johor Menteri Besar Onn Hafiz Ghazi announced that foreign investors in the Johor-Singapore Special Economic Zone (JS-SEZ) have agreed to offer premium salaries starting from RM3,500 to local workers. To be specific, a minimum salary of RM3,500 and above will be set for diploma holders, while degree holders should be offered at least RM4,000. A little bit of a reality check, at the moment, the average base salary for new graduates is RM2,891 per month in Johor. If we only take the minimum threshold, it would take a mammoth effort to increase the minimum monthly salary by more than 20% in a short period of time, while our annual salary growth rate is only between 5% and 6%. Berangan boleh but biarlah berpijak di bumi yang nyata.

Source: https://theedgemalaysia.com/node/755851

Business news

- PEOPLElogy Bhd has broken the curse of underperforming initial public offerings (IPOs) on the ACE Market in the past two months, after gaining 6%, priced at 26.5 sen, above its IPO price of 25 sen. Before PEOPLElogy’s debut, all nine companies listed since March have ended their first day of trading underwater. However, PEOPLElogy’s IPO only barely missed the drop as applications from investors barely covered the amount of shares offered for subscription.

- Petronas says no Sarawak, no problem, as the national oil & gas company is in discussions with Indonesia’s Pertamina and French energy group TotalEnergies to form a partnership for the development of the Bobara oil block in Indonesia. The block, which the government estimates has 6.8 billion barrels of oil equivalent, will be Petronas’ first deep-water project in Indonesia as an operator.

- The US International Trade Commission has voted to impose a tariff rate as high as 3,521% on imported solar cells and modules from Cambodia, Malaysia, Thailand and Vietnam, as the imported products are injuring domestic manufacturers such as Hanhwa Q Cells and First Solar Inc. Focusing on each country, the average duty was 396% for Vietnam, 375% for Thailand and 34% for Malaysia. Yay for US domestic manufacturer, but nay for US renewable energy developer, as this will stagnate renewable energy adoption. The US imported USD12.9 bil in solar equipment last year from the four nations, accounting for nearly 80% of total shipments.

Around the S.E.A.

The US credit rating was downgraded

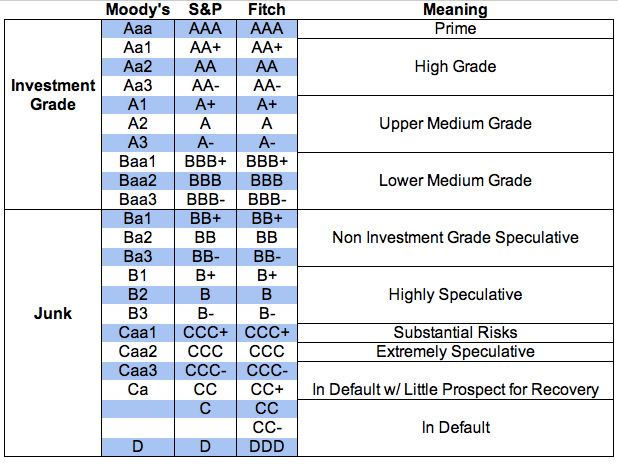

The US has been expelled from the elite AAA rated country club that includes countries such as Australia, Germany, Norway, Singapore, and Switzerland. This happened after a major international ratings firm, Moody’s Investor Service, downgraded the US from AAA rated, down a notch to AA1, leaving the US without a major AAA rating for the first time in a century. Moody cited three main reasons for this rate cut, namely – a) increased federal spending; b) planned tax cuts by US President Donald Trump and c) political dysfunction means this trend is ‘likely to deteriorate’. The move by Moody’s was not surprising as its rivals already pulled that trigger back in 2011 (S&P) and 2023 (Fitch) after arguments of debt concerns in Congress, and Moody’s itself already warned back in 2023 it’d be next. So do we all need to panic now? Not really, as when S&P first cut America’s rating in 2011, the market was quick to forget, and the move by Moody’s was inevitable, late and expected.

Source: https://www.straitstimes.com/business/economy/what-us-losing-its-last-triple-a-credit-rating-means

As for Malaysia, the US rating downgrade led to a stronger Ringgit, where our currency closed at 4.2870/4.2945 against last Friday’s 4.2900/4.2980. Btw, Malaysia’s credit rating at A3.

For your EYES only

Textbook example on how poorly a country balances its geopolitical needs and green agenda, as Taiwan recently closed down its last nuclear reactor in a move to so-called create a ‘nuclear free homeland’. Moving forward, the country’s electricity generation will be highly dependent on coal and natural gas, up to 81%, which are mostly imported via ships, as Taiwan is an island state. This huge blunder by the Taiwanese Government makes the country very vulnerable, energy security-wise, as China could easily impose a sea blockade and Taiwan will be dark, as quickly as a flip of a switch.

The CCP watching Taiwan, an easily blockaded island, shut down its nuclear reactors and make itself dependent on LNG tankers for energy. https://t.co/imaFVTkVz9 pic.twitter.com/a0qevE9AVA

— Kane 謝凱堯 (@kane) May 20, 2025