- The new LRT line in Penang and Kedah Darul Battery is materialising

- Gamuda is winning big in Taiwan

- Is Petronas struggling or just being smart?

IN Malaysia

Exciting things are brewing up in the North

- Shenzhen-listed Kedali Industry Co Ltd will be pushing RM365 mil to the table to build a lithium battery precision structural parts plant in Kedah. The construction of the plant, including the installation of advanced equipment will take about 36 months to complete and upon full production of the plant, the annual output value is estimated at about RM789 mil. The soon-to-be-completed plant will be producing precision structural components for power and energy storage batteries in the United States. Kedah Darul Battery is taking shape day by day.

- In making Penang and the Greater Penang area the true Klang Valley 2.0, Penang Infrastructure, Transport and Digital Committee chairman Zairil Khir Johari said that both Mass Rapid Transit Corporation Sdn Bhd (implementing agency) and SRS Konsortium (contractor) are in the final stage of contract negotiations, in building the Penang Pearl Line LRT. The RM10.5 bil project will be kickstarted with the constriction of the first segment of the Line from Silicon Island to Komtar.

Shorts

- Gamuda Bhd is winning big in the global market as a construction firm via its joint venture (JV) has secured an RM4.3 bil main design and build contract by the Department of Rapid Transit Systems, New Taipei City Government, to build the Xizhi Donghu Mass Rapid Transit (MRT) in Taiwan. Although the contract is initially worth RM4.3 bil, however, an additional work package worth RM10.8 bil is already being determined for JV, just pending the activation by the New Taipei City Government. Cumulatively, the contract value for the Gamuda JV is RM15.1 bil, more than the value of the Penang Pearl Line LRT project. Not bad Gamuda.

- Petroliam Nasional Bhd (Petronas) is looking at the market as it mulls over selling a minority stake in its renewable energy firm Gentari Sdn Bhd to expand the business of the subsidiary. According to The Edge, the unspecified ‘minority’ stake could be worth up to RM2.17 bil. Is Petronas short of cash to invest in its renewable energy arm (no thanks to Petros) or just looking for the right partner to make Gentari fly? Whatever it is, 2024 is not the ‘ong’ year for the state-owned oil & gas firm.

- The state of the e-invoicing adoption is good as the Ministry of Finance (MOF) announced that a total of 7.400 companies have adopted the new invoice system, with 58 mil e-invoices issued as of October 14. This statistic only involved companies in the first phase of the e-invoicing rollout (large companies with annual sales over RM100 mil). The second phase will commence on Jan 1, 2025, involving companies with annual revenues of between RM25 mil and RM100 mil.

Around the S.E.A.

Is the end is near?

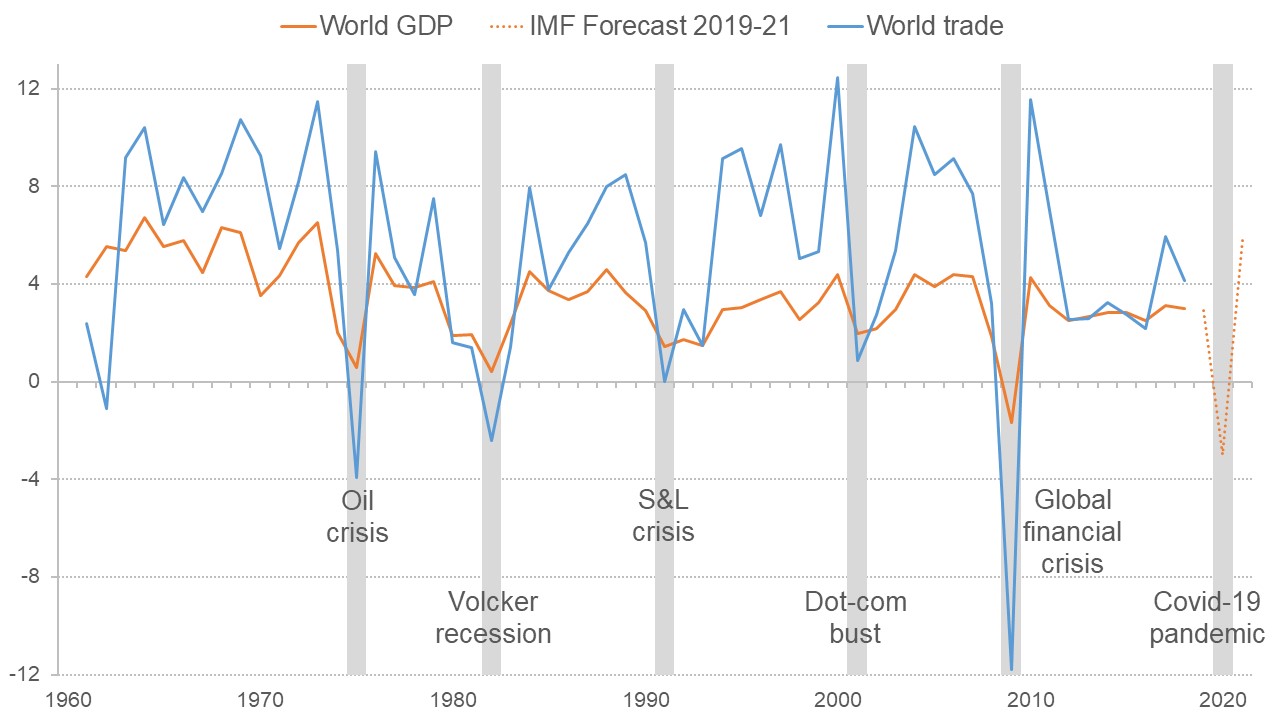

We are not talking about the arrival of the Messiah but the next so called mini recession. A mini recession is akin to the feeling of experiencing a low cost flight landing, with its unique ‘Gedegak’ sound. It is hard and bumpy but you will survive. The signs are there if you know where to look. We are calling it the Gedegak Economy.

- Struggling financial institution – Although the German-based Deutsche Bank is recording profit in the third quarter, however, the bank has increased its bad debt provision from EUR1.5 bil to EUR 1.8 bil, partly due to the slumping Germany’s economy which has started to take a toll on the bank.

In the United States, major banks such as Wells Fargo, Bank of America, JP Morgan and Citigroup are increasing their reserves more than usual, in anticipation of a spike in bad debts as more US consumers and businesses are having trouble paying off their debts. Apart from that, according to data from the Federal Reserve, credit card and auto loan delinquency rates are on an increasing trend, moving towards the numbers of 2008. We do not have to mention what happened in 2008, touch wood.

Source: https://www.businessinsider.com/big-banks-preparing-loan-loss-credit-card-auto-debt-cre-2024-10

- Decreasing the central bank’s interest rate – An interest rate cut is always a precursor to a recession akin to a warning sound before a tsunami strikes the coast. A few central banks such as the Bank of Thailand and Bank of Canada are seriously considering further rate cuts. As for the latter, the Bank of Canada is considering a jumbo rate cut to reduce the borrowing cost amidst stagnating economic growth. In the past three decades, there have only been three periods of larger-than-normal rate cuts: in 2001, after the US dot-com bubble and Sept 11 attacks, during the global financial crisis in 2008-09, and in 2020, in the midst of the Covid-19 economic shock. Only the 2001 cuts didn’t coincide with a recession.

According to the graph above, a recession normally happens every 10 years and the last one was during the pandemic. However, we still need to remain cautious as any outlier events could trigger the next recession.

In the face of red flags from the market, investors need to be smart in where they put their money. Companies should look at countries that have always been resilient during recession times. Nowadays, geopolitical tension has also affected the decision of where to invest. Now is not the time to pick sides between the East or the West, choose the country that knows how to play the balancing act. If you identify that country already (i.e. Malaysia), what are you waiting for, put all your money in that country!

For your EYES only

Recently, it has become a hot topic as netizens fighting over what is the definition of T15 in the announced Budget 2025 by PMX. Now, our Economy Minister has stepped up to explain. Are you satisfied with his explanation?

Gaji RM7,000 sebulan dah tak layak dapat subsidi RON95? Kalau belum dimuktamadkan kenapa umum dahulu? Tak buat homework ke?

YAB Perdana Menteri mengumumkan pelaksanaan penyasaran semula subsidi RON95 tahun depan.

Banyak komen di luar sana dan saya faham ini peluang yang baik… pic.twitter.com/bwTTmXEptY

— Rafizi Ramli (@rafiziramli) October 22, 2024