- For today, this edition will be dedicated to the recently announced Belanjawan 2025. We will try our best to do justice in covering Budget 2025. Enjoy!

IN Malaysia

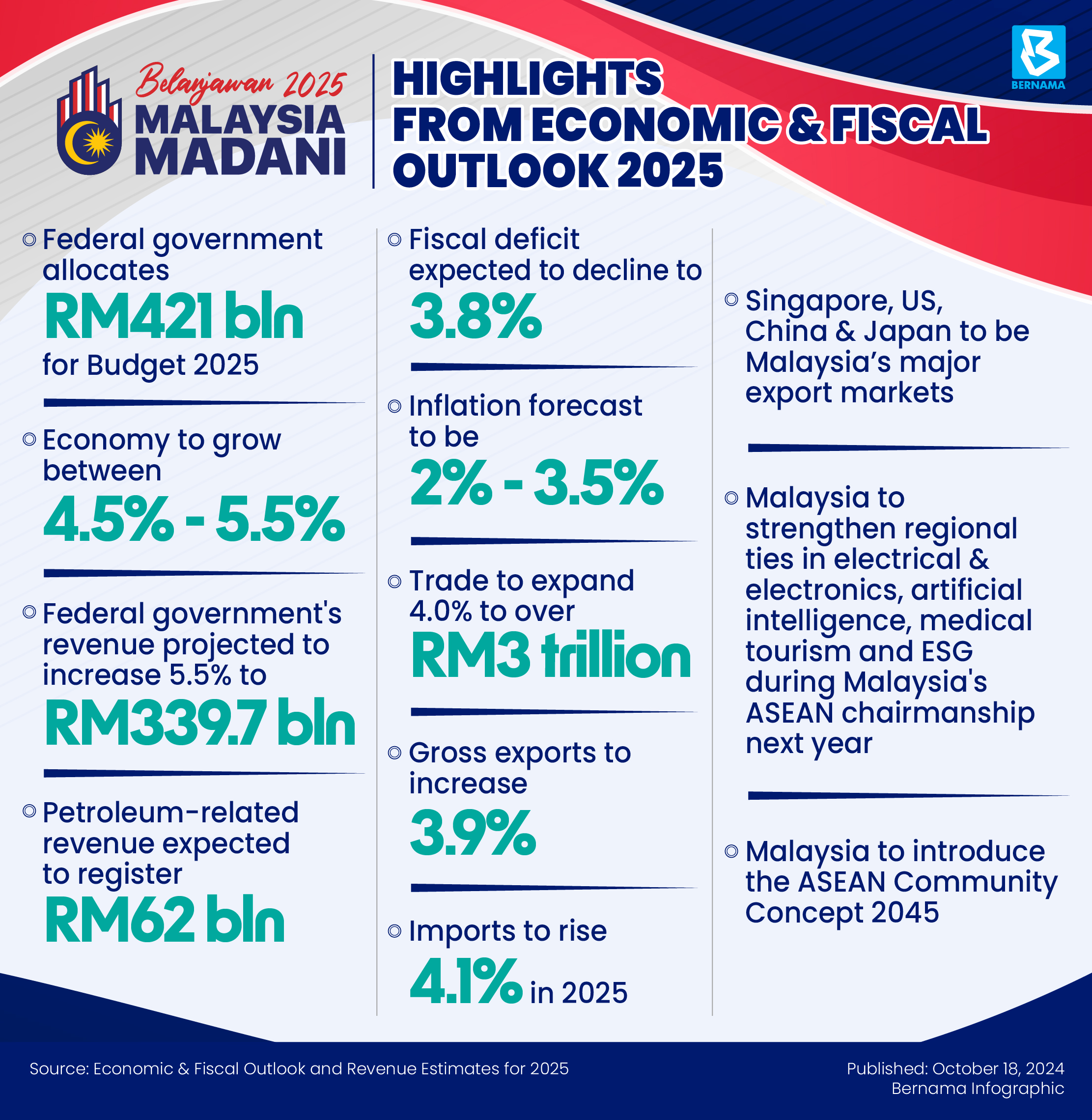

We kick start things with the key highlights from Belanjawan 2025, the last annual budget announced as part of the 12th Malaysia Plan –

- The GST will not be reintroduced but instead, the existing sales and service tax (SST) will be expanded from May 1, 2025, to cover premium imported goods (avocados, salmon) and commercial services such as fee-based financial services.

- A 2% dividend tax will be introduced for dividend income exceeding RM100,000. However, dividend income from government funds such as EPF and ASB will be exempted. Fuh, thank god.

- The war on sugar will continue and the excise duty imposed on sugar-sweetened beverages will increase from 50 sen to 90 sen.

- The blanket subsidy for RON95 and the subsidy for health and education will be rationalised. PM Anwar stated that only the T15 group will be affected. What is the definition of T15? Who the hell knows.

- The monthly minimum wage will increase from RM1,500 to RM1,700 effective Feb 1, 2025. Employers with fewer than five workers will be given a six-month grace period.

- Putrajaya will mandate EPF contributions for foreign workers too, to be implemented in phases.

- The Federal Government will raise Sabah and Sarawak’s special grant from RM300 mil to RM600 mil.

- A new law to introduce house arrest will be drafted soon. At the moment, house arrest is not a form of punishment under Malaysian law. However, there is an exemption under Section 3 of the Prisons Act 1995 that may allow any house to be used as a ‘prison’. So, Najib Razak out of prison, here we go soon?

We lay down the highlights, and now let’s go into some of the details –

New Investment Incentive Framework (NIIF) to be rolled out

PM Anwar Ibrahim announced that NIIF could be introduced as early as 3Q2025 which will be a game changer in attracting high-value investments into the country. As part of the new framework, economic clusters unique to the strength of each state will be established and tax incentives will be given to 21 economic sectors in various states. These moves will be done to reduce the development gap between the rest of the country in comparison to the Klang Valley. 2025 is the year to implement Dasar Pandang ke North!

Based on Belanjawan 2025, we believe that these two areas will be of increased interest – smart logistics complex (SLC) and data centre. For the former, Putrajaya intends to grant a 60% investment tax allowance for 5 years (that could be set off against up to 70% of annual statutory income) to logistics companies that engaged in SLC. SLC is a modern warehouse that uses technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) to automate various warehouse operations, reduce costs and enhance overall supply chain performance. Basically, imagine a J&T or DHL warehouse, instead of humans, only robots sorting out your parcel. Canggih kan?

As for data centres, during the Post Budget 2025 Debate organised by the Malaysian Economic Association, Treasury secretary-general Johan Mahmood Merican said that Putrajaya is restructuring the incentive packages for data centre investments as at certain times these high CAPEX investments do not value-add the rakyat. Moving forward, all incentives for investments including for these power-hungry and water-thirst data centres, will be based on a scorecard approach, where points are given based on factors such as the ability to generate high-income jobs, linkages to local businesses, and sustainability features, amongst others. The higher the score, the higher the incentives.

https://theedgemalaysia.com/node/730958

2025 is the year of new taxes both for consumers and businesses

Multinational enterprises (MNE) that have an effective tax rate below 15% after enjoying a slew of tax incentives need to face the reality now as Putrajaya will impose a global minimum tax (GMT). GMT is basically a tax regime aimed at ensuring that MNEs to pay the right amount of taxes, that is at 15%, thus nullifying the effect of tax incentives. However, in order to still make Malaysia a prime destination for FDIs, a slew of non-tax incentives will be introduced under the New Investment Incentive Framework (NIIF).

You may ask, why we are shooting ourselves in the leg by implementing GMT? GMT is a worldwide cooperation, signed by more than 140 countries, to reduce the overall injustice of national and global tax structures. So, after this, there will be no more tax havens and capitalist companies will need to start to pay their dues in taxes. We need to be happy with GMT as this is one of the rare moments where the whole world is working together. – Michael Jackson’s We Are The World song playing in the background –

Now even foreign workers need to pay for EPF

EPF CEO Ahmad Zulqarnain Onn lauded the Government’s move to ensure the compulsory coverage of the EPF to non-Malaysian workers, as this move will level the playing field in the labour market. Now, employers cannot save their pockets anymore by hiring foreign workers instead of local workers hehe. He added that this new policy will benefit over 2 mil non-Malaysian workers in Malaysia.

As expected, industry bodies such as the Master Builders Association Malaysia (MBAM) have urged Putrajaya to defer the foreign workers’ EPF plan, citing ‘significant’ cost implications, especially for the construction sector. On top of the increased minimum wage to RM1,700, MBAM president Oliver Wee stated that an additional cost of a minimum of RM110 mil per month needs to be fork up by the construction industry. For the first half of 2024, according to the Construction Industry Development Board, the industry enjoyed RM88.92 bil in new contract awards from 7,000 projects. Major construction companies such as Sunway Construction (16.3%) and Kerjaya Prospek (13.8%) have always enjoyed a healthy gross prospect margin of between 10% – 20%. So, in another way, the new EPF plan will only trim their profits but not their survivability.

All in all, the budget focuses more on expanding the country’s revenue while targeting the proceeds for Rakyat’s welfare programs. No flashy projects were announced which include no news on the KL-Singapore High Speed Rail and Klang Valley MRT3 Project. Nonetheless, Belanjawan 2025 is still the country’s biggest budget, with RM421 bil of expenditure programs announced, a 3.31% increase compared to last year’s budget.

For your EYES only

Even Putrajaya is subsidising the pain that Manchester United fans are suffering this year. Thank you PMX and Ten Hag Out!

Alhamdulillah terima kasih PMX 🤲🏽 pic.twitter.com/7AKTz6jC4j

— Abah (@chairmanGLC) October 19, 2024