- JPMorgan to pay Malaysia RM1.4 bil in relation to 1MDB.

- BYD to set an assembly plant in Tanjung Malim, Perak.

- TSMC mendonia

IN MALAYSIA

Military jet explosions trigger a key conversation – are we buying the right military hardware?

Last week, an F/A-18D Hornet, based in Kuantan Air Force Base, was engulfed in flames, moments after it took off from the runway. The crash marks the first loss from Malaysia’s fleet of eight American-made Hornets, procured in 1997 for RM1.6 bil. Although all of the Hornets were bought brand-new back then, at the moment, the Hornets are 28 years old and one less due to the accident. Putrajaya has a plan to purchase 33 second-hand F/A-18s from Kuwait to boost our defence, but is buying old airframes akin to purchasing ‘flying coffins’, as the King stated previously?

Interesting fact – both pilots of the downed aircraft in Kuantan survived the crash with minor injuries, marking the 7,796th and 7,797th lives saved by the jet’s ejection seats, made by US-based Martin-Baker Aircraft Company.

https://x.com/MB_EjectEject/status/1958804647897923706

Deliberating further on the purchase of used F/A-18s from Kuwait, Defence Minister Khaled Nordin said that if the procurement of the Kuwaiti jets takes too long, Putrajaya will consider procurement for new fifth-generation (5G) jets to replace the fleet by 2040. Khaled added that Malaysia will only be able to receive these jets once Kuwait receives their new jets from the US. Currently, including the remaining F/A-18D Hornets, Malaysia only has 37 operational fighters, albeit not all are at 100% operational-ready. As a comparison, Singapore has 99 operational fighters. Ini baru the military situation in the air, we belum touch on the state of our naval assets lagi.

In relation to a similar matter, Khalid has also announced that his ministry has issued a fresh tender to lease four helicopters for the Army Air Corps, after cancelling a previous award to a company that failed to deliver the aircraft. Moving forward, during the evaluation process, the Defence Ministry will take into account the views expressed by the King of Malaysia, where His Majesty Sultan Ibrahim criticised the Government’s practice of purchasing second-hand assets.

Business news

-

JP Morgan will pay a RM1.4 bil settlement to Malaysia in relation to 1MDB

JPMorganChase will pay RM1.4 bil to Malaysia to resolve existing and potential claims related to the 1Malaysia Development Bhd (1MDB) scandal. As an outcome of this settlement, each party will withdraw all appeals connected with the lawsuit filed by 1MDB against JPMorgan in the Kuala Lumpur High Court. Malaysia is not a poor country. Personally, we prefer Putrajaya to play the chicken game with JPMorgan because until the day corporates admit their mistake, history is bound to repeat itself.

-

BYD to set up an assembly plant in Malaysia

The Chinese automotive giant, BYD Company Ltd, will set up its first automotive assembly plant in Malaysia in Tanjong Malim, Perak. BYD will be the anchor tenant in KLK Bhd’s new 1,500-acre KLK TechPark, where the former will occupy up to 150 acres. The 1,500-acre integrated industrial hub is a hub for advanced manufacturing and green technology.

AROUND THE SEA

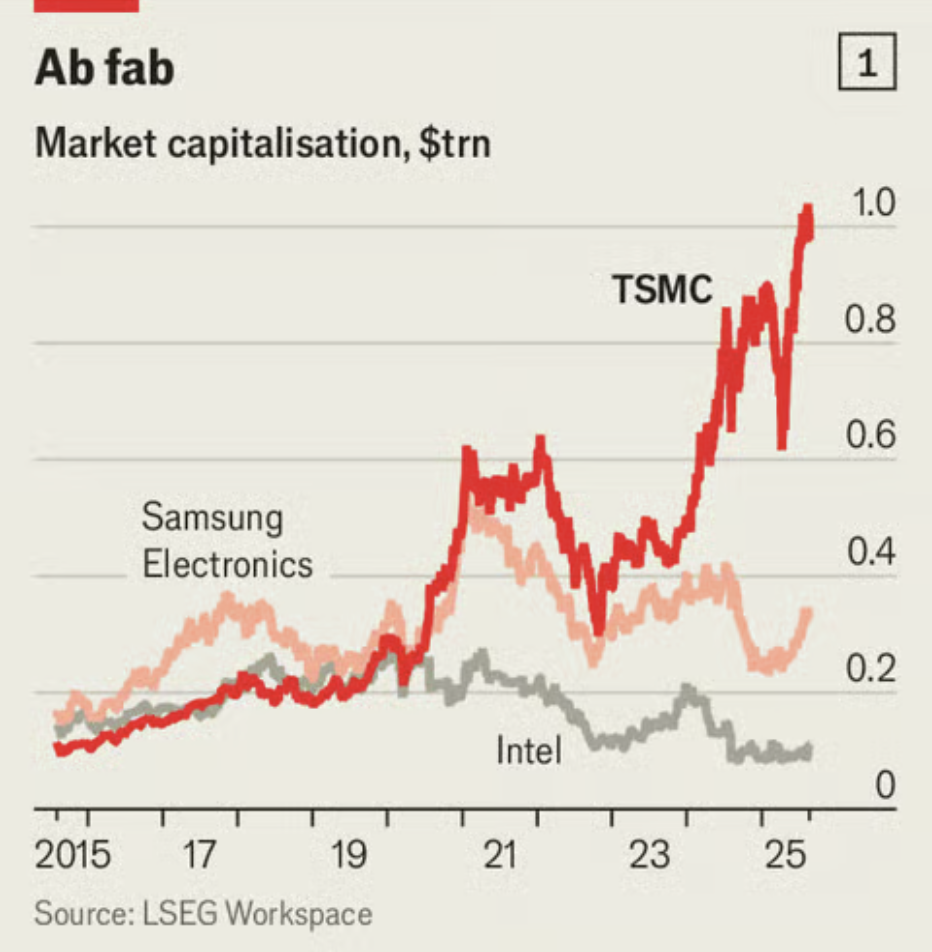

TSMC need to look beyond Taiwan

TSMC, arguably the largest producer of chips, where the company easily control more than two-thirds of the market, is embarking on a tricky expansion, beyond the borders of Taiwan.

For most of its history, TSMC made all of its cutting-edge chips in Taiwan. Although the firm has long operated a few overseas plants making less sophisticated chips, it has only recently begun shifting some of its most advanced manufacturing abroad (including the USD165 bil expansion to Arizona, US). Expansion is vital for TSMC’s long-term survival, as Taiwan is becoming too small for TSMC –

- Not enough power – In 2023, TSMC accounted for 8% of the island’s electricity use. By 2030, its share could rise to nearly a quarter.

- Not enough skilled manpower – Taiwan has few immigrants and a fertility rate of just 0.9, whereas a rate of 2.1 is necessary to sustain the population.

- Not enough land – Even TSMC’s latest fab in Kaohsiung, spanning 79 hectares, was built on a former oil refinery and required a good deal of soil reclamation.

- Taiwan is beside China – A Chinese invasion would render the company’s fabs inoperable, since they depend on a ‘real-time connection with the outside world, as per TSMC’s chairman, Mark Liu.

- Balancing the geopolitical pressure – Six out of seven of TSMC’s biggest clients are based in the US. By building a factory closer to its clients, TSMC is hedging the risk of being alienated by the US, as Trump is starting to invest heavily in its client cum competitor, Intel.

This is a good time for a neutral country like Malaysia to lure TSMC to set up shop in the country. We have always been welcoming to both East and West, and plus, we are just a pond away from Taiwan. Forget about data centres, companies like TSMC are the real deal and the high-quality FDIs that we want.

Source: https://www.cnbc.com/2025/08/22/intel-goverment-equity-stake.html

In an unrelated matter, another Taiwan-based company, Foxconn, is also undergoing a pivot in its company’s direction in order to remain competitive. Foxconn, a company that is well-known as the ‘factory floor’ of Apple, has now shifted its focus from consumer electronics to AI. The company is now producing AI servers, as the demand for any AI infrastructure is increasing. According to Foxconn CEO Kathy Yang, the company’s Cloud and Networking Products division delivered 41% of total revenue, surpassing the company’s Smart Consumer Electronics unit for the first time. The CEO predicted Q3 will see revenue from AI servers grow 170%, and sales of server racks will grow by 300%. Foxconn expects full-year revenue from AI servers to top USD33 bil. Gila babi lah Foxconn.

For Your EYES Only

RM300k given to RXZ Members organisers. What do you think about this?

RM300k taxpayers money to support them. I’m speechless. pic.twitter.com/1aV4kogOcQ

— Roman Akramovich (@SyedAkramin) August 24, 2025